PART II AND III

Published on September 30, 2025

PART II – PRELIMINARY OFFERING CIRCULAR DATED SEPTEMBER 29, 2025

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

OFFERING CIRCULAR

1206 Laskin Road Suite 201-o

Virginia Beach, Virginia 23451

(757) 821-2121

www.GOTV.com

FullPAC, Inc.

Up to 10,000,000 Shares of Common Stock

Placement Agent Warrants to Purchase Up to 700,000 Shares of Common Stock

Up to 700,000 Shares of Common Stock Underlying the Placement Agent Warrants

By this offering circular (the “Offering Circular”), FullPAC, Inc., a Nevada corporation, is offering on a “best-efforts” basis a maximum of 10,000,000 shares of its common stock (the “Offered Shares”), at a fixed price of $5.00 per share, pursuant to Tier 2 of Regulation A of the United States Securities and Exchange Commission (the “SEC”). There is no minimum purchase requirement for investors in this offering. For a description of the securities being offered hereby, please see the section entitled “Securities Being Offered” beginning on page 74.

This offering is being conducted on a “best-efforts” basis, which means that there is no minimum number of Offered Shares that must be sold by us for this offering to close; thus, we may receive no or minimal proceeds from this offering. All proceeds received from this offering will be placed in an escrow account held by Wilmington Trust, National Association, as escrow agent (the “Wilmington Trust Escrow Account”). We intend to complete one or more closings on a rolling basis. Upon each closing, the gross proceeds from accepted subscriptions will be released from escrow at the mutual written discretion of us and the Placement Agent (as defined herein), at which point such proceeds will become immediately available to us and may be used as they are released. Purchasers of the Offered Shares will not be entitled to a refund and could lose their entire investments. Please see the “Risk Factors” section, beginning on page 8, for a discussion of the risks associated with a purchase of the Offered Shares.

We estimate that this offering will commence within two days of SEC qualification; this offering will terminate at the earliest of (a) the date on which all of the Offered Shares have been sold, (b) one year from the date of SEC qualification, or (c) the date on which this offering is earlier terminated by us, in our sole discretion. We intend to complete one or more closings on a rolling basis. Until we complete a closing, all proceeds from this offering will be kept in the Wilmington Trust Escrow Account. At each closing, the proceeds will be distributed to us and the associated Offered Shares will be issued to the investors. If there are no closings or if funds remain in the Wilmington Trust Escrow Account upon termination of this offering without any corresponding closing, the funds so deposited for this offering will be promptly returned to investors without deduction and without interest. See “Plan of Distribution”.

Price to Public | Commissions(1) | Proceeds to Company(2) | ||||||||||

| Per Share | $ | 5.00 | $ | 0.35 | $ | 4.65 | ||||||

| Total Maximum | $ | 50,000,000 | $ | 3,500,000 | $ | 46,500,000 | ||||||

| (1) | We have engaged Dawson James Securities, Inc., member FINRA/SIPC (the “Placement Agent”) to act as an exclusive broker-dealer on a best efforts basis for this offering. We have agreed to pay the Placement Agent a fee equal to 7.0% of the gross proceeds received in this offering, subject to certain exceptions. We have also agreed to issue to Placement Agent or its designees warrants to purchase shares of common stock equal to 7.0% of the aggregate number of Offered Shares sold in this offering at an exercise price equal to 125% of the price per Offered Share sold in this offering (the “Placement Agent Warrants”). See “Plan of Distribution” for more details. | |

| (2) | Does not reflect payment of expenses associated with this offering, which are estimated not to exceed $4,979,500. This amount represents the proceeds to the Company, which will be used as set forth in “Use of Proceeds”. |

Investing in the Offered Shares is speculative and involves substantial risks. You should purchase Offered Shares only if you can afford a complete loss of your investment. See “Risk Factors”, beginning on page 8, for a discussion of certain risks that you should consider before purchasing any of the Offered Shares.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF, OR GIVE ITS APPROVAL TO, ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

The use of projections or forecasts in this offering is prohibited. No person is permitted to make any oral or written predictions about the benefits you will receive from an investment in the Offered Shares.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. No sale may be made to you in this offering, if you do not satisfy the investor suitability standards described in this Offering Circular under “Plan of Distribution—State Law Exemption and Offerings to “Qualified Purchasers” on page 44. Before making any representation that you satisfy the established investor suitability standards, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

We are following the “Offering Circular” format of disclosure under Regulation A and relying upon “Tier 2” of Regulation A+, which allows us to offer up to $75 million in a 12-month period.

In accordance with the requirements of Tier 2 of Regulation A+, we will be required to publicly file annual, semi-annual, and current event reports with the SEC after the qualification of the offering statement of which this Offering Circular is a part.

The date of this Offering Circular is _______________, 2025.

TABLE OF CONTENTS

| 2 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this Offering Circular includes some statements that are not historical and that are considered forward-looking statements. Such forward-looking statements include, but are not limited to, statements regarding our development plans for our business; our strategies and business outlook; anticipated development of our company; and various other matters. These forward-looking statements express our expectations, hopes, beliefs and intentions regarding the future. In addition, without limiting the foregoing, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “believes,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “possible,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” “would” and similar expressions and variations, or comparable terminology, or the negatives of any of the foregoing, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this Offering Circular are based on current expectations and beliefs concerning future developments that are difficult to predict. We cannot guarantee future performance, or that future developments affecting our company will be as currently anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements.

All forward-looking statements attributable to us are expressly qualified in their entirety by these risks and uncertainties. These risks and uncertainties, along with others, are also described below in the section entitled “Risk Factors”. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. You should not place undue reliance on any forward-looking statements and should not make an investment decision based solely on these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

| 3 |

You should rely only on the information contained in this Offering Circular that we may authorize for use in connection with this offering. We have not authorized any other person to provide you with different or additional information. If anyone provides you with different, additional or inconsistent information, you should not rely on it. We are not making an offer to sell or soliciting an offer to buy the Offered Shares in any jurisdiction in which an offer or solicitation is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation. You should assume that the information appearing in this Offering Circular in connection with this offering is accurate only as of the date of those respective documents. Our business, financial condition, results of operations and prospects may have changed since those dates. You should read this Offering Circular in its entirety before making an investment decision. You should also read and consider the information in the documents to which we have referred you in the sections of this Offering Circular entitled “Where You Can Find More Information.”

In making an investment decision, investors must rely on their own examination of the Company and the terms of the offering, including the merits and risks involved. These securities have not been recommended by any federal or state securities commission or regulatory authority. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacy of this document. Any representation to the contrary is a criminal offense. These securities are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under the Securities Act of 1933, as amended, and the applicable state securities laws, pursuant to registration or exemption therefrom. Investors should be aware that they will be required to bear the financial risks of this investment for an indefinite period of time.

We are offering to sell, and seeking offers to buy, the Offered Shares only in jurisdictions where offers and sales are permitted. The distribution of this Offering Circular and the offering of the Offered Shares in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this Offering Circular must inform themselves about, and observe any restrictions relating to, the offering of the Offered Shares and the distribution of this Offering Circular outside the United States. This Offering Circular does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by Offering Circular by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

We have not, and the Placement Agent has not, authorized anyone to provide any information or to make any representations other than those contained in this Offering Circular or in any free writing offering circulars prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The information contained in this Offering Circular or in any applicable free writing offering circular is current only as of its date, regardless of its time of delivery or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date.

Notice to Foreign Investors: We have not, and the Placement Agent has not, done anything that would permit this offering or possession or distribution of this Offering Circular in any jurisdiction where action for that purpose is required, other than in the United States. If the investor lives outside the United States, it is the purchaser’s responsibility to fully observe the laws of any relevant territory or jurisdiction outside the United States in connection with any purchase of the securities, including obtaining required governmental or other consents or observing any other required legal or other formalities. The Company reserves the right to deny the purchase of the securities by any foreign investor. This Offering Circular is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. We are not, and the Placement Agent is not, making an offer to sell these securities in any state or jurisdiction where the offer or sale is not permitted.

Unless the context indicates otherwise, as used in this prospectus supplement, references to “we,” “us,” “our,” “the Company” and “FullPAC” refer to FullPAC, Inc. and its consolidated subsidiaries.

We obtained the industry and market data in this Offering Circular from our own research as well as from industry and general publications, surveys and studies conducted by third parties. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate is necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and elsewhere in this Offering Circular. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us. References in this Offering Circular to any publications, reports, surveys or articles prepared by third parties should not be construed as depicting the complete findings of the entire publication, report, survey or article. The information in any such publication, report, survey or article is not incorporated by reference in this Offering Circular.

All trademarks, trade names and service marks appearing in this Offering Circular are the property of their respective owners. Solely for convenience, the trademarks and trade names in this Offering Circular are referred to without the ® and TM symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

Effective June 26, 2025, we conducted a forward stock split such that 25,000 shares of common stock became 15,000,000 shares of common stock. The forward stock split has been retroactively adjusted throughout this Offering Circular and the financial statements and notes thereto.

| 4 |

The following summary highlights material information contained in this Offering Circular. This summary does not contain all of the information you should consider before purchasing our common stock. Before making an investment decision, you should read this Offering Circular carefully, including the section entitled “Risk Factors” and the consolidated financial statements and the notes thereto included elsewhere in this Offering Circular.

Overview

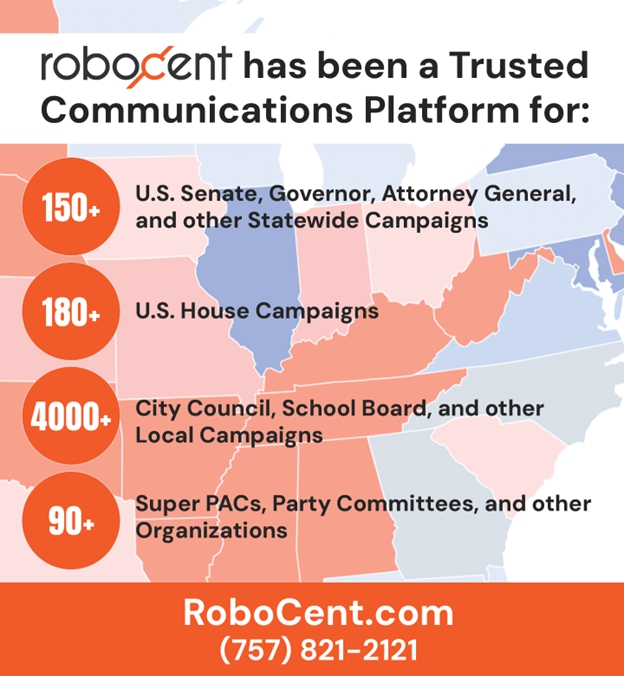

FullPAC is a campaign services company that operates the RoboCent technology platform (“RoboCent”), which provides political communication tools with a core focus on peer-to-peer messaging solutions. We offer campaign outreach tools for political candidates, advocacy organizations, and nonprofit clients seeking to deliver timely, targeted outreach at scale. As of the date of this Offering Circular, over 5,000 campaigns have utilized RoboCent for compliant voter contact, fundraising, and persuasion. RoboCent’s clients are able to send targeted messages typically within two hours. We are a Gold Member of the American Association of Political Consultants.

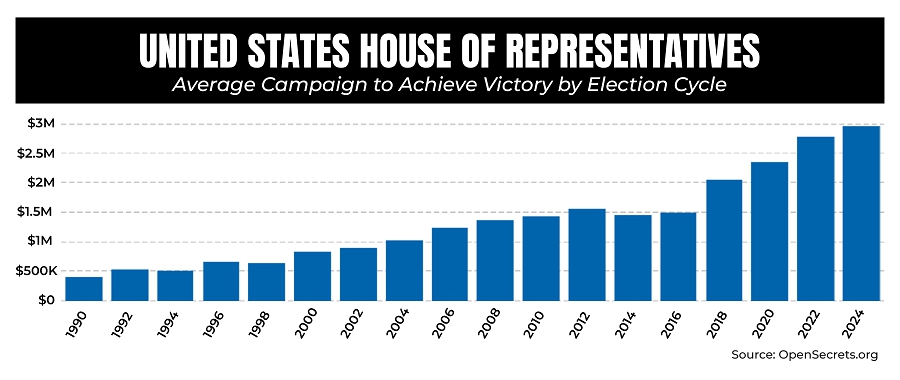

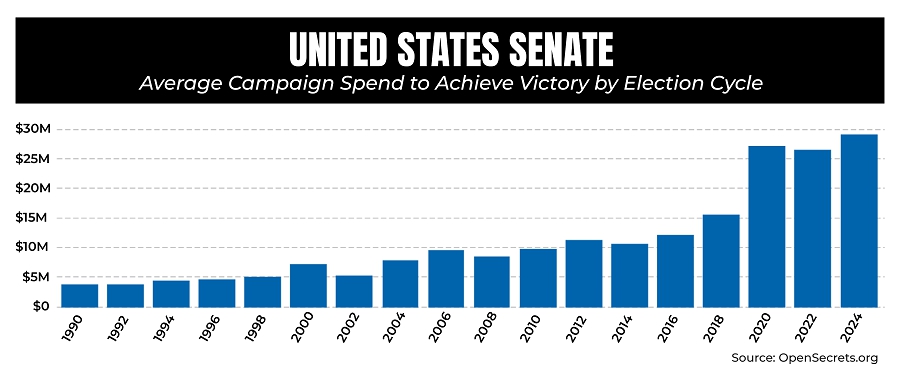

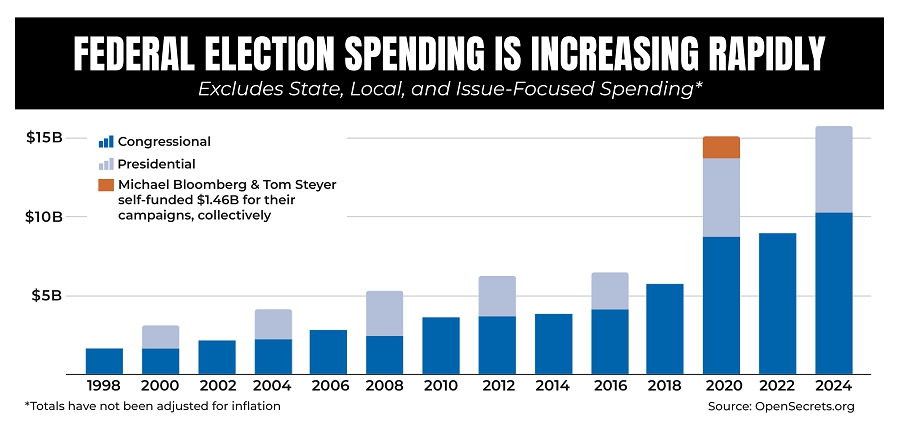

Spending on elections in the United States has increased significantly. According to data from OpenSecrets, the average winner of a federal legislative election in 1990 spent $407,556 on their campaign for the House and $3,870,621 on their campaign for the Senate. By 2010, the average spend had roughly tripled, with House winners spending an average of $1,439,997 and Senate winners spending an average of $9,782,702 on their campaigns. The numbers increased seven-fold by 2022, when the average House winner spent $2,789,859 and the average Senate winner spent $26,525,065 on their campaigns. According to OpenSecrets, on an inflation-adjusted basis, total expenditures on presidential and congressional elections increased from $3.1 billion in 2000 to $18.3 billion in 2020.

The foregoing figures represent only federal political spending in the U.S. and exclude spending by campaigns for public offices at the state, county, city, or district level. Besides races for office, political organizations have increased their spending to influence public opinion. According to OpenSecrets, in 2022, more than $1 billion was spent to support or oppose state-level ballot measures placed directly before voters, with 27 different ballot measures generating at least $5 million each in spending. Additionally, outside spending in connection with races for office has increased with the proliferation of super PACs and other issue-oriented organizations. Any organization that wants to connect with voters where such communication relates to an election or political issue represents a potential client for our services.

The ultimate purpose of this unparalleled level of political expenditure is to execute the singular function of a political campaign: to persuade and mobilize citizens to vote. This recurring effort to “get out the vote” is the essential machinery that drives the democratic process, turning billions of dollars in spending from a disparate set of donors into the exercise of one of America’s most fundamental rights. The objective and high-stakes nature of an election, with a clear winner and no consolation for the loser, creates a powerful incentive for campaigns and advocacy organizations to deploy all available resources to connect with every potential supporter. This willingness to spend whatever is necessary to secure a vote, particularly in the days leading up to an election, is a primary driver of the market for our services.

Further, we benefit from the increasing hyper-politicization of American politics and deepening political divide. We believe there is a shrinking pool of voters that can be persuaded by either of the two main political parties. While RoboCent is regularly utilized in contacting such undecided voters, it is not what generates the majority of our revenue. In recent years, leading candidates within both of the main political parties in the United States have increasingly adopted base politics, which often involves sending sensationalized communications to supporters and members of their own political party to elicit emotional reactions. We believe that this strategy is highly effective at driving voter turnout, generating donations, raising awareness, and shaping the narrative of key events amongst a candidate’s supporters, and that we are positioned to significantly benefit from a trend that regularly involves messaging outreach campaigns to a significant portion of the electorate.

We believe we are positioned to benefit from continued intensity in the political environment irrespective of overall partisan trends. Many campaign service providers are region-centric and specialize in working with ideologically-aligned groups or candidates, limiting their potential market for clients and increasing the risk that a shift in the political climate will lead to widespread turnover in their client base. In contrast, we have a history of working with candidates on organizations on any side of the political aisle, from throughout the United States, and are well-positioned to tailor our offerings in response to macro political trends. Unlike a campaign service provider whose alignment or offerings would limit them to working with a particular party or in a particular region of the country, we are able to offer services to any and all of the groups involved in a nationwide debate.

Principal Products and Services

FullPAC’s core offerings include:

| ● | Peer-to-Peer (“P2P”) Messaging – An industry-leading, Telephone Consumer Protection Act (“TCPA”), Federal Communications Commission (“FCC”), and 10-Digit Long Code (“10DLC”)-compliant SMS/MMS messaging solution enabling real-time text outreach with customized voter engagement. | |

| ● | RoboCalls – A voice broadcasting platform allowing campaigns to send pre-recorded messages to the landline phones of a curated list of voters or constituents. |

| 5 |

| ● | Voter Data – Landline, mobile, and email contact information for registered voters allowing clients to engage in data-driven campaigning. | |

| ● | Public Opinion Polling – Survey software designed to collect and analyze actionable feedback from voter segments. | |

| ● | Microtargeting Hub– Clients can use the RoboCent self-service interface to manage lists, message delivery, and reporting, or delegate management tasks to members of the FullPAC team. |

All services are designed to be compliant with relevant federal and state communications laws and allow for easy integration with voter databases and third-party customer relationship management systems (“CRMs”).

Our products are generally distributed through a cloud-based software-as-a-service (SaaS) model. Clients can access RoboCent’s tools directly through our web-based dashboard or utilize the FullPAC service offerings for turnkey campaign management services.

We believe that we are positioned to capitalize on changes in political campaign spending in upcoming election cycles. Historically, spending on political campaigns has been directed towards legacy technologies, such as direct mail or television advertising. Campaign services have been provided by individual contractors or small firms, often with ties to a particular region and partisan affiliation. In contrast, we have built a digital-first and viewpoint-neutral platform that we believe will better position us to compete for an increasing share of the growing market for campaign services As more campaigns become increasingly professionalized operations with significant budgets, we believe our offerings and technology platform will appeal to data-driven clients seeking more attention and feedback assessment than other forms of voter outreach.

Politics is unique in that winning an election is singular and objective – well-financed campaigns will pay a premium to work with the most competent and experienced specialists in each aspect of politicking. A meritocracy exists in politics to a far greater extent than other industries. At the same time, once part of a winning politician’s team, vendors are often retained for incumbent’s reelection campaigns.

Currently, we are building a premier campaign distribution channel, starting with political texts, which we plan to expand with other high-margin services. We are actively exploring AI-generated political ads, micro-targeted voter polling, fintech products for campaigns, and other highly-scalable technology services.

We are currently planning to roll up leading, specialized service providers focused on certain campaign functions and may use the proceeds from this offering to fund such acquisitions. We believe that consolidating talent will not only increase the likelihood of our existing campaigns expanding their relationship with FullPAC, but will also increase our ability to attract well-financed campaigns seeking to engage top talent.

Further, we expect consolidating campaign talent will be highly attractive to super PACs and other organizations with the explicit purpose of outspending the competing campaign in an effort to win a particular election. Often, these organizations are willing to pay a premium to engage top talent and deploy significant resources implementing their recommended strategy and tactics. Due to its effectiveness and scale, RoboCent has been engaged by numerous super PACs over the past decade in highly competitive U.S. Senate, gubernatorial, and Congressional races.

Recent Developments

Acquisition of Advocacy Lab

On September 29, 2025, and effective as of October 1, 2025, we entered into an Agreement and Plan of Merger with Advocacy Lab LLC, a limited liability company organized under the laws of the state of Michigan (“Advocacy Lab”) pursuant to which we agreed to acquire Advocacy Lab for aggregate gross cash consideration of $45,000, payable at the closing of the transaction (the “Advocacy Lab Acquisition”). In connection with the Advocacy Lab Acquisition, we have entered into employment agreements with each of Kevin Rose and Karl Brycz (together, the “AL Founders”), effective as of October 1, 2025 (collectively, the “AL Employment Agreements”). Pursuant to the terms of the AL Employment Agreements, each of the AL Founders shall receive a signing bonus of $75,000 and a base salary of $110,000 per annum, payable in cash, as well as customary benefits, including participation in the Company’s healthcare and retirement plans. Pursuant to the terms of the AL Employment Agreements, each of the AL Founders shall earn a percentage of all revenues generated by Advocacy Lab based on the following tiers, with a cap on such Earn Out Payments (as defined below) of $5.35 million in the aggregate: (i) for $0 to $1 million in revenue, 50% to the AL Founders, (ii) for $1 million to $2.5 million in revenue, 40% to the AL Founders, (iii) for $2.5 million to $5 million in revenue, 30% to the AL Founders, (iv) for $5 million to $10 million in revenue, 20% to the AL Founders, (v) for $5 million to $10 million in revenue, 10% to the AL Founders, and (vi) for $20 million to $50 million in revenue, 5% to the AL Founders (collectively, the “Earn Out Payments”). No further Earn Out Payments shall be owed upon the earlier of (i) October 1, 2035, and (ii) the achievement of $50 million in revenue generated by Advocacy Lab.

Additionally, for any current existing users of Advocacy Lab that become customers of RoboCent, the AL Founders shall receive a commission of equal to 25% of the revenue generated from such customer accounts. For any future RoboCent customers sourced through Advocacy Lab, Advocacy Lab shall be entitled to receive a 2% commission, with such commission to continue until the earlier of (i) October 1, 2035, and (ii) the receipt of $2.5 million by the AL Founders in aggregate commission.

Our Bitcoin Accumulation Strategy

In September 2025, we adopted a bitcoin accumulation strategy, allowing us to acquire and hold up to the lower of (i) $10 million and (ii) 50% of our liquid assets in bitcoin, and made bitcoin one of our primary treasury reserve assets on an ongoing basis, subject to market conditions and our anticipated cash needs. Our strategy includes long-term acquisition and holding of bitcoin, subject to market conditions, using one or a combination of cash flows from our business operations, issuing equity or debt securities, and/or engaging in other capital raising transactions with the objective of using the proceeds to purchase bitcoin. Notwithstanding the foregoing, we do not currently intend to use the proceeds from this offering to purchase bitcoin. We expect to view our bitcoin as long-term holdings, but we may periodically sell or otherwise dispose of bitcoin for corporate purposes, tax strategies, or other applicable financing transactions. We may also use our bitcoin as collateral for financing or to generate income. We have no specific accumulation target and will monitor market conditions in determining whether to engage in additional bitcoin purchases.

Our Corporate Information

We are a Nevada corporation that was incorporated in June 2025. Our wholly owned subsidiary, RoboCent, Inc., was incorporated in the State of Delaware in 2012 and reincorporated in the Commonwealth of Virginia in August 2016. In June 2025, the sole shareholder of RoboCent, Inc. approved an Agreement and Plan of Merger with FullPAC, Inc. Pursuant to the Agreement and Plan of Merger, the sole shareholder of RoboCent, Inc. received the same class and number of shares of stock in FullPAC, Inc. as he previously held in RoboCent, Inc., FullPAC, Inc. became the sole shareholder of RoboCent, Inc., and RoboCent, Inc. became a wholly owned subsidiary of FullPAC, Inc.

Our principal executive and administrative offices are located at 1206 Laskin Road Suite 201-O, Virginia Beach, Virginia, 23451, and our telephone number is (757) 821-2121. Our website address is www.gotv.com. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of the SEC’s website is www.sec.gov. Information on or accessed through our website or the SEC’s website is not incorporated into this Offering Circular.

Corporate Governance

Effective upon the listing of our common stock on a national securities exchange (a “Public Listing”), we will have a standing Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee to oversee critical aspects of our business and financial reporting. The membership of these committees will consist entirely of independent directors. The Board has also prospectively adopted a Code of Business Conduct and Ethics, an Insider Trading Policy, a Whistleblower Policy, and other corporate policies, each of which will become effective upon a Public Listing, is designed to comply with applicable laws and regulations, including Nasdaq listing rules, and aligns with best practices for public companies.

| 6 |

SUMMARY OF RISK FACTORS

Our business is subject to numerous risks, as more fully described below in this “Risk Factors” section. The following is a summary of the most significant risks and uncertainties that we believe could adversely affect our business, financial condition, and results of operations. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may adversely affect our business, financial condition, and/or operating results. In addition to the following summary, you should read the other information set forth below in this “Risk Factors” section before you invest in our securities. In particular, our risks include, but are not limited to, the following:

Risks Related to Our Common Stock and this Offering

| · | Our common stock will not be listed on any national securities exchange (“NSE”) or other trading market, and we cannot be certain that a liquid trading market for our common stock will develop. |

| · | Our plan to list our common stock on Nasdaq may never be realized or may progress slower than we expect, resulting in a significant delay between your investment and the creation of a liquid trading market or the inability to sell or dispose of our common stock. |

| · | This is a “best efforts” offering; no minimum amount of shares of common stock is required to be sold, and we may not raise the amount of capital we believe is required for our business. |

| · | Using a credit card to purchase the Offered Shares may impact the return on your investment as well as subject you to other risks inherent in this form of payment. |

| · | Our management will have broad discretion over the use of the net proceeds from this offering. | |

| ● | The voting power of our stock is concentrated with our officers and directors, which will limit an investor’s ability to influence the outcome of important transactions, including a change of control. |

Risks Related to our Business and Financial Condition

| · | Our ability to grow and compete in the future will be adversely affected if adequate capital is not available to us or not available on terms favorable to us. |

| · | The market for programmatic buying for political advertising campaigns is dynamic and evolving. If this market develops more slowly or differently than expected, our business, operating results and financial condition may be adversely affected. |

| · | We have historically relied on a limited number of clients for a substantial portion of our revenue, and the loss of these clients could harm our business. |

| · | Our success and revenue growth is dependent on our marketing efforts, ability to maintain our brand, adding new clients, and increasing usage of our platform and services by our customers. |

| · | Our business depends, in part, on the success of our strategic relationships to attract potential clients for our services, and our ability to grow our business depends on our ability to continue these relationships. |

| · | We may be unsuccessful in launching or marketing new products or services, or we may be unable to successfully integrate new offerings into our existing platform, which would result in significant expense and may not achieve desired results. |

| · | Our business is heavily tied to the United States electoral calendar. Political campaign spending tends to increase near certain milestone dates, which we expect to create fluctuations in our operating results on a quarter-to-quarter and year-to-year basis. |

| · | We expect to experience a high rate of client and subscriber churn. |

| · | Changes in campaign finance laws or patterns of political spending could adversely affect our business. |

| · | Our association with clients who become involved in public scandals or controversies could damage our reputation and brand, regardless of our non-partisan stance. |

| · | We identified material weaknesses in our internal control over financial reporting and may identify additional material weaknesses in the future or otherwise fail to maintain an effective system of internal control, which may result in material misstatements of our financial statements or cause us to fail to meet our periodic reporting obligations. |

Risks Related to Intellectual Property and Information Technology

| · | Our failure to adequately protect our intellectual property rights could diminish the value of our products, weaken our competitive position and reduce our revenue, and infringement claims asserted against us or by us, could have a material adverse effect. |

| · | A disruption to our information technology systems could adversely affect our business and reputation. |

| · | Cyberattacks, cyber fraud, and unauthorized data access could harm us or our clients and result in liability, and could adversely affect our business and results of operations. |

| · | We are dependent on the continued availability of third-party hosting and transmission services. Operational issues with, or changes to the costs of, our third-party data center providers could harm our business, reputation or results of operations. |

Risks Related to Government Regulations

| · | Changes in legislative, judicial, regulatory, or cultural environments relating to information collection, use and processing may limit our ability to collect, use and process data. Such developments could cause revenue to decline, increase the cost of data, reduce the availability of data and adversely affect the demand for our products and services. |

| · | We are subject to regulation with respect to political campaign activities, which lacks clarity and uniformity. |

| · | Our business is dependent on text messaging and voice communication channels, and our access to these channels could be limited by regulatory or industry actions, including from mobile network operators or designers of mobile operating systems. |

| · | Individuals may claim our calling or text messaging services are subject to, and are not compliant with, the Telephone Consumer Protection Act or similar state laws. |

| · | Artificial intelligence (“AI”) presents risks and challenges that can impact our business, including by posing security risks to our confidential information, proprietary information and personal data. |

Risks Related to our Bitcoin Strategy and Holdings

| · | Our bitcoin strategy will expose us to various risks associated with bitcoin including, but not limited to, due to the fact that bitcoin is a highly volatile asset, it does not pay interest or dividends, has not been tested over an extended period of time or under different market conditions and is subject to counterparty risks such as risks relating to custodians. |

| · | Bitcoin and other digital assets are novel assets, and are subject to significant legal, commercial, regulatory and technical uncertainty. |

| · | Our historical financial statements do not reflect the potential variability in earnings that we may experience in the future relating to our bitcoin holdings. |

| · | Our bitcoin strategy subjects us to enhanced regulatory oversight. |

| · | Due to the unregulated nature and lack of transparency surrounding the operations of many bitcoin trading venues, bitcoin trading venues may experience greater fraud, security failures or regulatory or operational problems than trading venues for more established asset classes, which may result in a loss of confidence in bitcoin trading venues and adversely affect the value of our bitcoin. |

| · | The emergence or growth of other digital assets, including those with significant private or public sector backing, could have a negative impact on the price of bitcoin and adversely affect our business. |

| · | Our bitcoin strategy exposes us to risk of non-performance by counterparties. |

| 7 |

| Securities Offered | 10,000,000 shares of common stock, are being offered by the Company in a “best-efforts” offering. | |

| Offering Price Per Share | A price of $5.00 per Offered Share. | |

| Shares Outstanding Before This Offering | 20,000,000 shares of common stock issued and outstanding as of September 25, 2025. | |

| Shares Outstanding After This Offering | 30,000,000 shares of common stock issued and outstanding, assuming all of the Offered Shares are sold hereunder. Excludes up to 700,000 shares underlying the Placement Agent Warrants and 1,000,000 shares reserved for issuance under our Founders Share Plan. | |

| Minimum Number of Shares to Be Sold in This Offering | There can be no guarantee that any of the Offered Shares will be sold and there is no minimum number that must be sold as a condition for us to complete the offering. | |

| Investor Suitability Standards | The Offered Shares are being offered and sold to “qualified purchasers” (as defined in Regulation A under the Securities Act of 1933, as amended (the “Securities Act”)). “Qualified purchasers” include any person to whom securities are offered or sold in a Tier 2 offering pursuant to Regulation A under the Securities Act. | |

| Termination of this Offering | This offering will terminate at the earliest of (a) the date on which all of the Offered Shares have been sold, (b) the date which is one year from this offering being qualified by the SEC and (c) the date on which this offering is earlier terminated by us, in our sole discretion. See “Plan of Distribution”. | |

| Use of Proceeds | We will use the proceeds of this offering to redeem the Senior Secured Notes issued from June through September 2025 and for general corporate purposes, including working capital. We are currently planning to roll up leading, specialized service providers focused on certain campaign functions and may use the proceeds from this offering to fund such acquisitions. See “Use of Proceeds”. | |

| Lock-Up Agreements | Each of our directors, officers and holders of more than 5% of the outstanding shares of our common stock as of the qualification date of this Offering Circular shall enter into customary lock-up agreements for a period of 90 days from the date of the final closing offering. Additionally, we have also agreed, for a period of 90 days from the final closing of the offering, that we will not offer, sell, or otherwise transfer or dispose of, directly or indirectly, any shares of our capital stock or any securities convertible into or exercisable or exchangeable for shares of our capital stock or file or cause to be filed any registration statement with the SEC relating to the offering of any shares of our capital stock or any securities convertible into or exchangeable for shares of our capital stock. See “Plan of Distribution.” | |

| Market for the Offered Shares | There is currently no public trading market for our common stock, and the Offered Shares will not be listed on any exchange upon the closing of this offering. Our long-term strategy includes a plan to list our common stock on The Nasdaq Capital Market (“The Nasdaq Capital Market” or “Nasdaq”). To satisfy the initial listing requirements of The Nasdaq Capital Market, we must, among other requirements, have a minimum of $15,000,000 in market value of unrestricted securities. We intend to satisfy this requirement through the gross proceeds from this offering. Our common stock will not be eligible for listing on The Nasdaq Capital Market until we satisfy Nasdaq’s initial listing requirements. We have reserved the ticker symbol “GOTV” with Nasdaq and have submitted an application for listing on The Nasdaq Capital Market. However, this offering is not contingent upon the approval of such a listing, and we can provide no assurance that our common stock will ever be listed on a national securities exchange. | |

| Risk Factors | An investment in the Offered Shares involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investments. You should carefully consider the information included in the Risk Factors section of this Offering Circular, as well as the other information contained in this Offering Circular, prior to making an investment decision regarding the Offered Shares. |

| 8 |

An investment in the Offered Shares involves substantial risks. You should carefully consider the following risk factors, in addition to the other information contained in this Offering Circular, before purchasing any of the Offered Shares. The risks and uncertainties discussed below are not the only ones we face. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may adversely affect our business, financial condition, and/or operating results. If any of the following risks actually occur, our business, reputation, financial condition, results of operations, revenue and future prospects could be materially adversely affected. In such case, the value of our securities could decline, and you may lose all or part of your investment. Some statements in this Offering Circular, including statements in the following risk factors, constitute forward-looking statements. See “Cautionary Statement Regarding Forward-Looking Statements”.

RISKS RELATED TO OUR COMMON STOCK AND THIS OFFERING

Our common stock will not be listed on any NSE or other trading market, and we cannot be certain that a liquid trading market for our common stock will develop.

Our common stock will not be listed on any NSE, interdealer quotation system or other trading market. There is no trading market for our common stock and there can be no assurance that any such trading market will develop in the future. You do not have any rights of redemption or repurchase rights with respect to our common stock. While we have applied to list our shares on The Nasdaq Capital Market, this offering is not contingent on such a listing. Therefore, any investment in our common stock will be highly illiquid, and investors may not be able to sell or otherwise dispose of our common stock for a significant period of time, if at all.

Our plan to list our common stock on Nasdaq may never be realized or may progress slower than we expect, resulting in a significant delay between your investment and the creation of a liquid trading market or the inability to sell or dispose of our common stock.

We have applied to list our common stock on The Nasdaq Capital Market and reserved the ticker symbol “GOTV”. However, our ability to qualify for a Nasdaq listing is subject to numerous factors, including having a minimum of $15,000,000 in market value of unrestricted securities, our ability to raise sufficient capital in this offering, attracting a sufficient number of stockholders to meet exchange requirements, and satisfying Nasdaq’s other quantitative and qualitative listing standards. We intend to satisfy the minimum market value of unrestricted securities requirement through the gross proceeds from this offering. However, there are no assurances that we will raise such minimum amount in market value of unrestricted securities. We may not be successful in meeting Nasdaq’s initial listing requirements and will not be eligible for Nasdaq listing until we satisfy such initial listing requirements. Even if we do meet the requirements, Nasdaq may reject our application for any reason, and we will be required to maintain compliance with Nasdaq’s listing requirements in order to avoid being delisted. You should not invest in this offering with the expectation that a Nasdaq listing will occur. The process of receiving approval for listing can be lengthy and expensive, and we may never receive approval to list our common stock on The Nasdaq Capital Market. There could be a significant delay between the closing of this offering and the eventual commencement of trading of our common stock on Nasdaq. During this period, your investment will remain illiquid.

A limited public trading market may cause volatility in the price of our common stock.

While we have applied for the listing of our common stock on The Nasdaq Capital Market, there can be no assurance that our common stock will ever be listed on Nasdaq or that a meaningful, consistent, and liquid trading market will develop. As a result, our stockholders may not be able to sell or liquidate their holdings in a timely manner, at the then-prevailing trading price of our common stock or at all. In addition, sales of substantial amounts of our stock, or the perception that such sales might occur, could adversely affect the price of our common stock, our stock price may decline substantially and our stockholders could suffer losses or be unable to liquidate their holdings.

Purchasers in the offering will suffer immediate dilution.

If you purchase our shares or common stock in this offering, the value of your shares based on our pro forma net tangible book value will immediately be less than the offering price you paid. This reduction in the value of your equity is known as dilution. At an assumed public offering price of $5.00 per share, purchasers of common stock in this offering will experience immediate dilution of approximately $(3.51) per share, representing the difference between the assumed public offering price per share in this offering and our pro forma as adjusted net tangible book value per share as of June 30, 2025, after giving effect to the Pro Forma Adjustments (as defined herein), this offering, and after deducting estimated offering expenses payable by us. See “Dilution.”

| 9 |

This is a “best efforts” offering; no minimum amount of shares of common stock is required to be sold, and we may not raise the amount of capital we believe is required for our business.

The Placement Agent has agreed to use its reasonable best efforts to solicit offers to purchase the Offered Shares being offered hereby, however, the Placement Agent has no obligation to buy any of the Offered Shares from us or to arrange for the purchase or sale of any specific number or dollar amount of the Offered Shares. Furthermore, there is no minimum offering amount required as a condition to the closing of this offering. As such, the actual offering amount and net proceeds to us after deducting Placement Agent fees and offering expenses payable by us are not presently determinable and may be substantially less than the maximum amounts set forth in this Offering Circular. We may sell fewer than all of the Offered Shares, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund in the event that we do not sell an amount of Offered Shares sufficient to pursue the business goals outlined in this Offering Circular, including the redemption of the approximately $1.25 million of Senior Secured Notes issued from June through September 2025 (each, a “Seed Note” and collectively, the “Seed Notes”). If we do not raise the amount of capital we believe is required for our business, we may need to raise additional funds, which may not be available or available on terms acceptable to us. Because there is no minimum offering amount in this offering, investors could be in a position where they have invested in us, but we are unable to fulfill our objectives due to a lack of interest in this offering.

Using a credit card to purchase the Offered Shares may impact the return on your investment as well as subject you to other risks inherent in this form of payment.

Investors in this offering have the option of paying for their investment with a credit card, which is not usual in the traditional investment markets. Transaction fees charged by your credit card company (which can reach 5% of transaction value if considered a cash advance) and interest charged on unpaid card balances (which can reach almost 25% in some states) add to the effective purchase price of the Offered Shares you buy. The cost of using a credit card may also increase if you do not make the minimum monthly card payments and incur late fees. Using a credit card is a relatively new form of payment for securities and will subject you to other risks inherent in this form of payment, including that, if you fail to make credit card payments (e.g. minimum monthly payments), you risk damaging your credit score and payment by credit card may be more susceptible to abuse than other forms of payment. Moreover, where a third-party payment processor is used, as in this offering, your recovery options in the case of disputes may be limited. The increased costs due to transaction fees and interest may reduce the return on your investment.

The SEC’s Office of Investor Education and Advocacy issued an Investor Alert dated February 14, 2018, entitled “Credit Cards and Investments – A Risky Combination,” which explains these and other risks you may want to consider before using a credit card to pay for your investment.

| 10 |

Our management will have broad discretion over the use of the net proceeds from this offering.

We currently intend to use the net proceeds from the sale of the Offered Shares under this offering to redeem the Seed Notes and for general corporate purposes, including working capital. In addition, we may use the proceeds from this offering to roll up leading, specialized service providers focused on certain campaign functions. We have not reserved or allocated specific amounts for any of the foregoing purposes, other than the mandatory redemption of the Seed Notes, and we cannot specify with certainty how we will use the net proceeds. See “Use of Proceeds”. Accordingly, our management will have broad discretion in the application of the net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. We may use the net proceeds for corporate purposes that do not increase our operating results or market value.

Furthermore, the net proceeds from this offering may not be sufficient to redeem the Seed Notes in full. The Seed Notes are secured by a first-priority lien on all assets of the Company. The Seed Notes mature pursuant to their terms on December 31, 2026, if not subject to an earlier mandatory redemption, and accrue interest at an annual rate of 15%, compounded daily. If we are unable to redeem the Seed Notes in full with the net proceeds from this offering, this may have an impact on our financial condition. In addition, if we are unable to redeem the Seed Notes prior to maturity or repay the Seed Notes in full upon maturity, we may be required to sell all or a significant portion of our assets constituting collateral securing the obligations under the Seed Notes to satisfy such obligations which may have a material adverse effect on our business and operations.

We have not paid cash dividends in the past and do not expect to pay dividends in the future. Any return on investment may be limited to the value of our common stock, which may decrease in value.

Since our reorganization in June of 2025, we have never paid cash dividends on our common stock and do not anticipate doing so in the foreseeable future. The payment of dividends on our common stock will depend on earnings, financial condition and other business and economic factors affecting us at such time as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on your investment will only occur if our stock price appreciates, which may not occur.

Our issuance of shares of preferred stock could adversely affect the market value of our common stock, dilute the voting power of common stockholders and delay or prevent a change of control.

Our board of directors has the authority to cause us to issue, without any further vote or action by the stockholders, shares of preferred stock in one or more series, to designate the number of shares constituting any series, and to fix the rights, preferences, privileges and restrictions thereof, including dividend rights, voting rights, rights and terms of redemption, redemption price or prices and liquidation preferences of such series.

The issuance of shares of preferred stock with dividend or conversion rights, liquidation preferences or other economic terms favorable to the holders of preferred stock could adversely affect the price for our common stock by making an investment in the common stock less attractive. For example, investors in our common stock may not wish to purchase common stock at a price above the conversion price of a series of convertible preferred stock because the holders of the preferred stock would effectively be entitled to purchase common stock at the lower conversion price, causing economic dilution to the holders of common stock.

Further, the issuance of shares of preferred stock with voting rights may adversely affect the voting power of the holders of our other classes of voting stock, either by diluting the voting power of our other classes of voting stock if they vote together as a single class or by giving the holders of any such preferred stock the right to block an action on which they have a separate class vote even if the action were approved by the holders of our other classes of voting stock. The issuance of shares of preferred stock may also have the effect of delaying, deferring or preventing a change in control of the Company without further action by the stockholders, even where stockholders are offered a premium for their shares.

Our corporate governance measures, which will be effective upon a Public Listing, may not take effect if a Public Listing is not achieved, and the concentration of our voting stock will limit your ability to influence corporate matters.

The Sarbanes-Oxley Act of 2002, as amended (“Sarbanes-Oxley”), as well as rule changes proposed and enacted by the SEC and NSEs as a result of Sarbanes-Oxley, require the implementation of various measures relating to corporate governance. These measures are designed to enhance the integrity of corporate management and the securities markets and apply to securities that are listed on those exchanges, including the Nasdaq Stock Market. Because we are not presently required to comply with many of the corporate governance requirements and because we chose to avoid incurring the substantial additional costs associated with such compliance sooner than legally required, we have not yet adopted certain of these measures.

| 11 |

We have adopted charters for our Audit, Compensation, and Nominating and Corporate Governance committees, as well as a Code of Business Conduct and other corporate policies designed to align with the corporate governance standards of a Nasdaq-listed company. However, such charters and policies will be effective only upon the listing of our common stock on an NSE. To satisfy the initial listing requirements of The Nasdaq Capital Market, we must, among other requirements, have a minimum of $15,000,000 in market value of unrestricted securities. We intend to satisfy this requirement through the gross proceeds from this offering. Our common stock will not be eligible for Nasdaq listing until it satisfies its initial listing requirements. This offering is not contingent on such a listing, and there is no guarantee that we will be able to meet Nasdaq’s listing requirements or that our application will be approved. If a listing does not occur, these enhanced governance structures, including the requirement that our key board committees be composed of independent directors, will not be implemented.

Although we have appointed independent directors to serve on our board of directors effective upon a Public Listing, we do not currently have independent audit or compensation committees. As a result, our Chief Executive Officer and our other officers have the ability, among other things, to determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our stockholders without protections against interested director transactions, conflicts of interest, if any, and similar matters, and investors may be reluctant to provide us with funds necessary to expand our operations.

The voting power of our stock is concentrated with our officers and directors, which will limit an investor’s ability to influence the outcome of important transactions, including a change of control.

Immediately prior to this offering, our officers and directors owned 91.58% of our outstanding and issued shares of common stock, and our Founder, Chief Executive Officer, and Chairman, Travis Trawick, owned 75% of our outstanding and issued shares of common stock. Assuming that all of the Offered Shares are sold in this offering, we expect that our officers and directors will own approximately 61.05% of our outstanding and issued shares of common stock, and approximately 50% of our outstanding and issued shares of common stock will be owned by Mr. Trawick. Accordingly, our officers and directors will be able to exercise control over all matters requiring our stockholders’ approval, including the election of our directors, amendments of our organizational documents and any merger, consolidation, sale of all or substantially all of our assets or other major corporate transactions. Our officers and directors may have interests that differ from yours and may vote in a way with which you disagree and which may be adverse to your interests. This concentrated control could have the effect of delaying, preventing or deterring a change in control of the Company, could deprive our stockholders of an opportunity to receive a premium for their shares as part of a sale of the Company, and could ultimately affect the price of our securities.

We will be required to publicly report on an ongoing basis under the reporting rules set forth in Regulation A for Tier 2 issuers. Therefore, we will be subject to ongoing public reporting requirements that are less rigorous than Exchange Act rules for companies that are not “emerging growth companies,” and our investors could receive less information than they might expect to receive from exchange traded public companies.

We will be required to publicly report on an ongoing basis under the reporting rules set forth in Regulation A for Tier 2 issuers. The ongoing reporting requirements under Regulation A are more relaxed than for “emerging growth companies” under the Exchange Act. The differences include, but are not limited to, being required to file only annual and semiannual reports, rather than annual and quarterly reports. Therefore, our investors could receive less information than they might expect to receive from exchange traded public companies.

Our management team has limited experience managing a public company.

Most members of our management team have limited experience managing a publicly traded company, interacting with public company investors and complying with the increasingly complex laws pertaining to public companies. Our management team may not successfully or efficiently manage our transition to being a public company that is subject to significant regulatory oversight and reporting obligations under the federal securities laws and the continuous scrutiny of securities analysts and investors. These new obligations and constituents require significant attention from our management and could divert their attention away from the day-to-day management of our business, which could harm our results of operations and financial condition.

Members of our management team have interests in or are employed by other business ventures that may divert their attention from our business and may from time to time be the subject of negative media coverage or public actions that could have a material adverse effect on the reputation of our management team or business.

Members of our management team have interests in or are employed by other business ventures. These outside responsibilities could divert their attention from our day-to-day operations and strategic management, and may from time to time result in negative media coverage, litigation, or adverse public actions. Any of the foregoing could have a material adverse effect on the reputation of our management team and, by extension, the Company, even if unrelated to our business.

Members of our management team presently have, and other members of our management team may in the future have additional, ownership interests in, employment by, and fiduciary or contractual obligations to other entities with which they are affiliated with whom we may or may not have a relationship. Such other ventures and entities could divert the attention of our management from our business or create conflicts of interest or the perception thereof. Such other entities and business ventures are, from time to time, subject to litigation or investigations that could materially and adversely affect the reputation and perception among our clients or potential team members, which could in turn materially and adversely affect our business, financial condition and results of operations.

| 12 |

The elimination of monetary liability against our directors, officers, and employees under Nevada law and the existence of indemnification rights for our obligations to our directors, officers, and employees may result in substantial expenditures by us and may discourage lawsuits against our directors, officers, and employees.

Our Articles of Incorporation and Bylaws contain provisions permitting us to eliminate the personal liability of our directors and officers to us and our stockholders for damages for the breach of a fiduciary duty as a director or officer to the extent provided by Nevada law. We may also have contractual indemnification obligations under any future employment agreements with our officers. The foregoing indemnification obligations could result in us incurring substantial expenditures to cover the cost of settlement or damage awards against directors and officers, which we may be unable to recoup. These provisions and the resulting costs may also discourage us from bringing a lawsuit against directors and officers for breaches of their fiduciary duties and may similarly discourage the filing of derivative litigation by our stockholders against our directors and officers even though such actions, if successful, might otherwise benefit us and our stockholders.

Upon a Public Listing, although we expect to maintain directors’ and officers’ liability insurance, such insurance may not be adequate to cover all liabilities that we may incur. Liabilities in excess of our insurance coverage may reduce our available funds to satisfy third-party claims and may adversely impact our cash position and financial condition.

Anti-takeover effects of certain provisions of Nevada state law could hinder a potential takeover of us.

Nevada has a business combination law that prohibits certain business combinations between Nevada corporations and “interested stockholders” for three years after an “interested stockholder” first becomes an “interested stockholder,” unless the corporation’s board of directors approves the combination in advance. For purposes of Nevada law, an “interested stockholder” is any person who is (i) the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the outstanding voting shares of the corporation or (ii) an affiliate or associate of the corporation and at any time within the three previous years was the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the then-outstanding shares of the corporation. The definition of the term “business combination” is sufficiently broad to cover virtually any kind of transaction that would allow a potential acquirer to use the corporation’s assets to finance the acquisition or otherwise to benefit its own interests rather than the interests of the corporation and its other stockholders.

The potential effect of Nevada’s business combination law is to discourage parties interested in taking control of us from doing so if these parties cannot obtain the approval of our board of directors. This could limit the price investors would be willing to pay in the future for shares of our common stock.

Our bylaws contain an exclusive forum provision, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers, employees or agents.

Our bylaws provide that, unless we consent in writing to the selection of an alternative forum, the state and federal courts in the State of Nevada shall be the exclusive forum for any litigation relating to our internal affairs, including, without limitation: (a) any derivative action brought on behalf of us, (b) any action asserting a claim for breach of fiduciary duty to us or our stockholders by any current or former officer, director, employee, or agent of us, or (c) any action against us or any current or former officer, director, employee, or agent of us arising pursuant to any provision of the Nevada Revised Statutes, the Articles of Incorporation, or the Bylaws.

For the avoidance of doubt, the exclusive forum provision described above does not apply to any claims arising under the Securities Act or Exchange Act. Section 27 of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder, and Section 22 of the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder.

The choice of forum provision in our bylaws may limit our stockholders’ ability to bring a claim in a judicial forum that they find favorable for disputes with us or our directors, officers, employees or agents, which may discourage such lawsuits against us and our directors, officers, employees and agents even though an action, if successful, might benefit our stockholders. The applicable courts may also reach different judgments or results than would other courts, including courts where a stockholder considering an action may be located or would otherwise choose to bring the action, and such judgments or results may be more favorable to us than to our stockholders. With respect to the provision making the state and federal courts in the State of Nevada the sole and exclusive forum for certain types of actions, stockholders who do bring a claim in the state and federal courts in the State of Nevada could face additional litigation costs in pursuing any such claim, particularly if they do not reside in or near Nevada. Finally, if a court were to find this provision of our bylaws inapplicable to, or unenforceable in respect of, one or more of the specified types of actions or proceedings, we may incur additional costs associated with resolving such matters in other jurisdictions, which could have a material adverse effect on us.

| 13 |

RISKS RELATED TO OUR BUSINESS AND FINANCIAL CONDITION

Our ability to grow and compete in the future will be adversely affected if adequate capital is not available to us or not available on terms favorable to us.

We have limited capital resources. Our ability to continue our normal and planned operations, to grow our business, and to compete in our industry will depend on the availability of adequate capital. We cannot assure you that we will be able to obtain additional funding from those or other sources when or in the amounts needed, on acceptable terms, or at all. If we raise capital through the sale of equity, or securities convertible into equity, it would result in dilution to our then-existing stockholders, which could be significant depending on the price at which we may be able to sell our securities. If we raise additional capital through the incurrence of additional indebtedness, we would likely become subject to further covenants restricting our business activities, and holders of debt instruments may have rights and privileges senior to those of our then-existing stockholders. In addition, servicing the interest and principal repayment obligations under debt facilities could divert funds that would otherwise be available to support development of new programs and marketing to current and potential new clients. If we are unable to raise capital when needed or on attractive terms, we could be forced to delay, reduce, or eliminate development of new programs or future marketing efforts, or reduce or discontinue our operations. Any of these events could significantly harm our business, financial condition, and prospects.

The market for programmatic buying for political advertising campaigns is dynamic and evolving. If this market develops more slowly or differently than expected, our business, operating results and financial condition may be adversely affected.

We primarily derive revenue from the distribution of political text and voice messages through our platform. We expect that such distribution of communications will continue to be our primary source of revenue for the foreseeable future, and that our revenue growth will largely depend on increasing clients’ usage of our platform and services. If the market for campaign spending deteriorates or develops more slowly than we expect, it could reduce demand for our platform and services, and our business, growth prospects and financial condition would be adversely affected.

In particular, the market for programmatic buying for political campaigns across multiple outreach channels is an emerging market. Our ability to provide capabilities across multiple communication channels may be constrained if we are not able to maintain or grow our service offerings, and some of our offerings may not gain market acceptance. We may not be able to accurately predict changes in overall industry demand for the channels in which we operate and cannot make assurances that our investment in channel development will correspond to any such changes. For example, we cannot predict whether the growth in demand for P2P text messaging will continue. Furthermore, if our channel mix changes due to a shift in customer demand, such as customers shifting their usage more quickly or more extensively than expected to channels in which we have relatively less functionality, features, or capabilities, then demand for our platform and service offerings could decrease, and our business, financial condition, and results of operations could be adversely affected.

We have historically relied on a limited number of clients for a substantial portion of our revenue, and the loss of these clients could harm our business.

Historically, a significant portion of our revenue in any given quarter and fiscal year has been generated by a small number of large clients. In the year ended December 31, 2024, we derived 44.01% of our revenue from three clients and for the six months ended June 30, 2025, we derived 25.07% of our revenue from two clients.

Our relationships with these clients are often tied to specific election cycles, and there is no assurance that we will be able to maintain these relationships or that our major clients will continue to use our services at historical levels, or at all.

The loss of one or more of our key clients or a significant reduction in their spending on our services could have a material adverse effect on our business, financial condition, and results of operations. We may not be able to attract new clients to replace the revenue generated by our larger clients in a timely manner, which would make it difficult to support our operational expenses and achieve our growth objectives.

| 14 |

As our costs increase, we may not be able to generate sufficient revenue to sustain our past profitability.

We are currently experiencing and anticipate continued future growth that could require substantial financial and other resources to, among other things:

| ● | develop our platform, including by investing in our engineering team; | |

| ● | create, acquire or license new products or features, and improve the functionality, availability and security of our platform; | |

| ● | improve our technology infrastructure, including investing in internal technology development and acquiring outside technologies; | |

| ● | develop internal controls over financial reporting, including by hiring necessary accounting and information technology personnel to establish sufficient internal controls; | |

| ● | cover general and administrative expenses, including legal, accounting and other expenses necessary to support a significantly larger organization; | |

| ● | cover sales and marketing expenses, including a significant expansion of our direct sales organization; | |

| ● | cover expenses relating to data collection and consumer privacy compliance, including additional infrastructure, automation and personnel; | |

| ● | cover costs associated with inflationary pressures across our suppliers and the rising costs of labor; and | |

| ● | explore strategic acquisitions. |

Investing in the foregoing, however, may not yield anticipated returns. Consequently, as our costs increase, we may not be able to generate sufficient revenue to sustain profitability.

Our success and revenue growth is dependent on our marketing efforts, ability to maintain our brand, adding new clients, and increasing usage of our platform and services by our customers.